5 million dollar life insurance policy cost

Your age may also play a role in your cost for whole life policy as well as your health and lifestyle for Universal Life Insurance only. By selling e-guides online courses e-books or virtual tutoring sessions you can start a million-dollar business for little upfront cost.

How Much Does A Million Dollar Life Insurance Policy Cost Life Insurance Quotes Life Insurance For Seniors Life Insurance Cost

The following estimates have been applied to the value of life.

. A 500000 whole life insurance policy for that same woman would be about 411 per month Source. Policy owners should always consult with a qualified tax adviser if they are concerned about possible taxation upon surrender of a life insurance policy. The amount of money you put into your life insurance policy known as the cost basis is not subject to taxation because after-tax dollars were used to fund the policy.

4 million policy -- 325-475. Average umbrella insurance costs are 150 to 300 per year for a 1 million policy another 75 for the next million and another 50 for every million after that. How Much Life Insurance Can I Get For 200 A Month.

Long-term care is the unsolved problem for so many people says Christine Benz director of personal finance at Morningstar an investment research firm in Chicago. 94 of hospitals in the US are in the process of adoption of EHRs. The ideal time to buy life insurance is when youre young and have a clean bill of health especially because life insurance companies are all about weighing the risks of the person purchasing the policy.

Canceling a term life policy is pretty straightforward. If youre in the market for new life insurance or want an expert to talk to we recommend RamseyTrusted provider Zander Insurance. Eddie 42 500000 15-year term life policy for 27 monthly.

A bank will purchase and own a life insurance policy on an executive or group of executives lives and the bank is listed as the beneficiary of the policy. Mary 50 250000 10-year term life policy for 23 monthly. However these permanent life insurance policies can be cost prohibitive compared to term policies.

How to Retire on 5 Million Dollars. 750000 No Exam Life Insurance 1 Million Life Insurance Policy- Best Rates By Age Million Dollar No Exam Term Life Insurance Rates Best Rates On A 2 Million Dollar Life Insurance Policy Two Million Dollar No Exam Term Life Insurance 3 Million Dollar Life Insurance Policy 4 Million Life Insurance Policy- Best. 3 million policy -- 275-425.

Weve found that the average cost of life insurance is about 147 per month for a term life insurance policy lasting 20 years and providing a death benefit of 500000. We have 858 billion of term life insurance in force and pay out an average of 46 million in benefit claims every day. You can typically cancel your life insurance policy at any time either by letting your insurer know or no longer paying premiums.

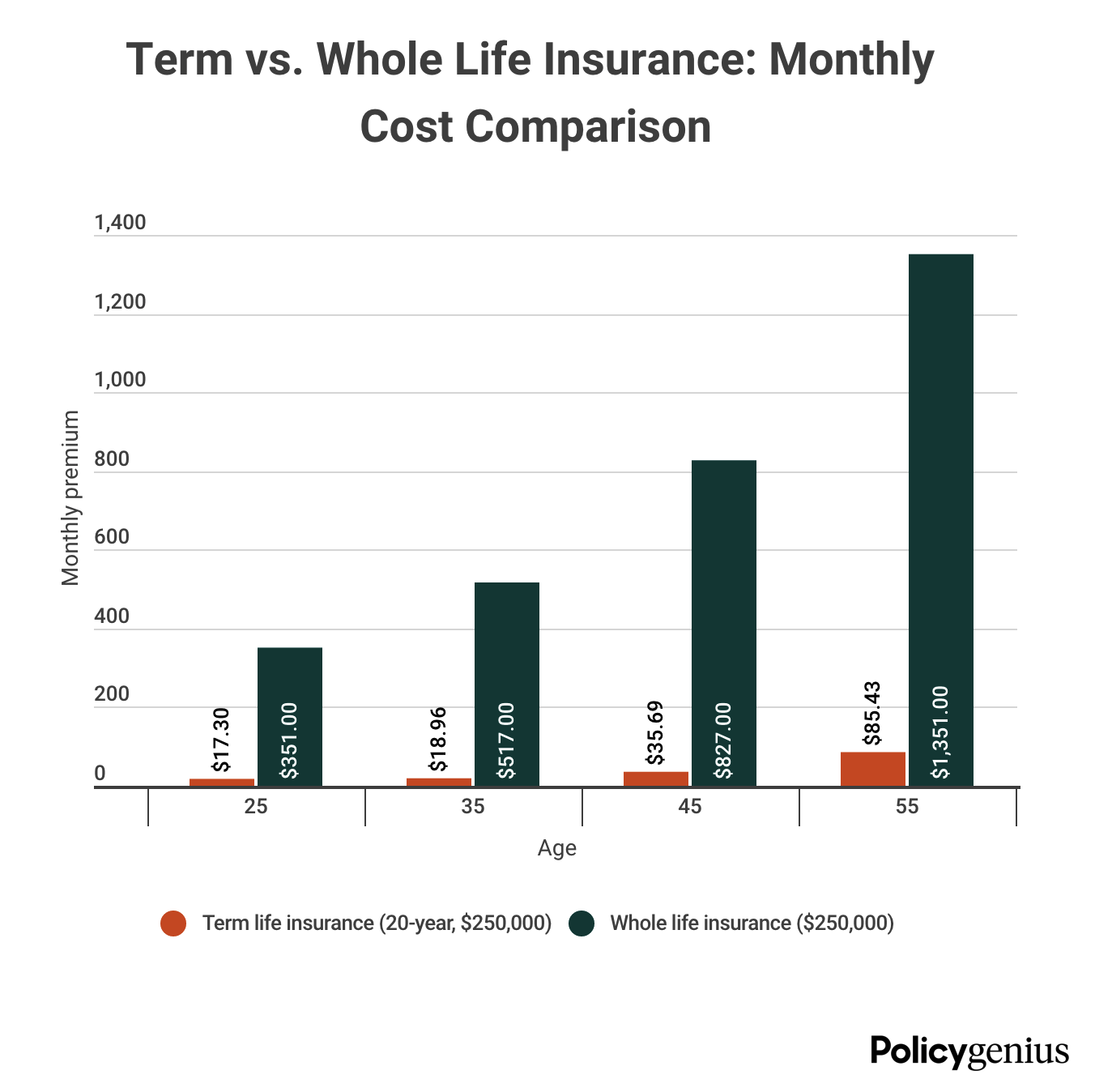

The main disadvantage of whole life insurance is that its more expensive than a term policyby quite a bit. Over 55 million lives are insured through our life companies Primerica Life Insurance Company Primerica Life Insurance Company of Canada and National Benefit Life Insurance Company. Doing this in a whole life insurance policy could reduce the death benefit by more than the amount you withdraw.

For example if you have a 250000 policy and withdraw 25000 your beneficiaries will only receive a 225000 death benefit from your policy. Life and health insurance premiums will rise to 29 to around 4 trillion but will recover to around 3 growth by the start of next year. 1 million policy -- 150-300.

Guaranteed Issue Whole Life Insurance does not require a medical exam or health questionnaire. As you can see the. In certain situations there may even be tax.

We have a vested interest in protecting your loved one. On the results of opinion poll life value as the cost of financial compensation for the death in the beginning of 2015 was about 71500. The average cost of a term life insurance policy for a healthy 40 year old is 24 month for a woman and 29 month for a man for a 500000 20-year term policy.

2 million policy -- 225-375. A Richard Martin insured a William Gybbons paying thirteen merchants 30 pounds for 400 if the insured dies within one year. Hit 347500 in the first quarter of 2021 according to the St.

If you use tobacco or have health issues the rate will be higher. But since permanent policies are life insurance and investment products rolled into one the process can be complex and time-consuming. Louis Federal ReserveThat means a million-dollar home is.

For example if you have 20000 in savings believe youre able to save or invest 400 a month and think you can achieve a 6 return on your money each year enter. In a universal life policy it may reduce the death benefit on a dollar-for-dollar basis. The first company to offer life insurance in modern times was the Amicable Society for a Perpetual Assurance Office founded in London in 1706 by William.

Dont let another day go by without. The earliest known life insurance policy was made in Royal Exchange London on 18 June 1583. A 30-year-old woman in excellent health would pay about 25 per month for a 30-year 500000 Haven Term policy.

Heres an estimate of umbrella insurance cost. 5 million policy -- 375-525. For 2021 the NFIP arranged for 115 billion in coverage from 32 private reinsurers up from 27 in 2020.

As long as you meet the age requirements for GIWL 50 to 85 years old you cant be turned down for health reasons. A heightened sense of health risk awareness and financial market conditions that are normalizing will drive the rebound. This means the cheapest policy available provides 1 million in coverage the next-cheapest policy offers 2 million in coverage and so on so you.

Methodology We researched and reviewed more than a dozen of the most popular insurance providers that offer umbrella insurance. The average monthly Social Security Income check-in 2021 is 1543 per person. According to different estimates life value in Russia varies from 40000 up to 2 million.

Primericas life companies are among the few that offer 35. Cash surrender values are allowed to grow tax-deferred to provide the bank with monthly bookable income. In the tables below well use an annuity with a lifetime income rider coupled with SSI to provide you a better idea of the income you could receive off 5 million dollars of retirement savings.

You should think of this number strictly as a baseline your own rates for life insurance will change depending on your age the insurer you choose and the amount of coverage you purchase. When the insured executive passes away the tax-free death benefits are paid to the bank and distributed according to the. The median sales price of houses sold in the US.

Since 2016 FEMAs National Flood Insurance Program has been using reinsurance protection. Since online education doesnt require physical. The cost of reinsurance coverage for 2021 was 1958 million compared to 205 million in 2020 for 133 billion of coverage.

Only 72 million or so Americans have LTC insurance which covers many of the costs of a nursing home assisted living or in-home care expenses that arent covered by Medicare. Over half of the population thinks the cost of a term life insurance policy is over three times the actual cost. Jon 30 1000000 10-year term life policy for 20 monthly.

Term Vs Whole Life Insurance Policygenius

Income Replacement Is A Broad Term For The Amount That Is Outsourced Or Invested In A Life Insurance Quotes Life Insurance Facts Life Insurance Marketing Ideas

Understanding The Life Insurance Medical Exam Policygenius

5 Tips For Selling Your Life Insurance Bankrate

9 Best Life Insurance Companies Of February 2022 Money

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

What Is Whole Life Insurance Cost Types Faqs

Life Insurance Over 70 How To Find The Right Coverage

Promoting Life Insurance To Millennials Life Insurance Facts Life Insurance Quotes Life Insurance Marketing

How Much Does Million Dollar Life Insurance Cost Who Needs It

Paid Up Additions Work Magic In A Bank On Yourself Plan

Can A Nursing Home Take Your Life Insurance

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Guide To Whole Life Insurance For 2022 Forbes Advisor

:max_bytes(150000):strip_icc()/AAALifeLogo_resize-d7b51e467fdf421d9af5ef581e9286cb.jpg)

The 5 Best Return Of Premium Life Insurance Of 2022

How Much Life Insurance Do You Need Forbes Advisor

Term Life Insurance Quotes Compare Life Insurance Rates Lifequote Com Life Insurance Facts Life Insurance Quotes Term Life Insurance Quotes

Why Whole Life Insurance Is Usually Not A Good Investment And What To Do If You Have Already Bought A Life Insurance Whole Life Insurance Life Insurance Policy